The nature of property as separate or community is determined by time and circumstances of its acquisition. The Texas Constitution, Article XVI, Sec. 15, defines Separate Property as: all property, both real and personal, of a spouse owned or claimed before marriage, and that acquired afterward by gift, devise, or descent, shall be the separate property of that spouse; 1

The nature of property as separate or community is determined by time and circumstances of its acquisition. The Texas Constitution, Article XVI, Sec. 15, defines Separate Property as: all property, both real and personal, of a spouse owned or claimed before marriage, and that acquired afterward by gift, devise, or descent, shall be the separate property of that spouse; 1

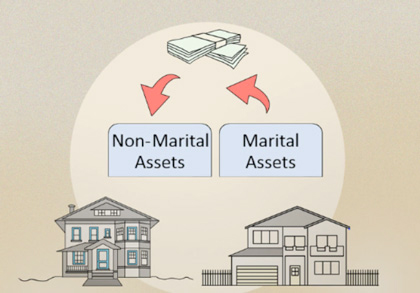

Characterization of assets relates to the application of marital property law, presumptions, and tracing. Tracing has been defined as a process that “involves establishing the separate origin of the property through evidence showing the time and means by which the spouse originally obtained possession of the property. Zagorski v. Zagorski, 116 S.W.3d309 (Tex.App. –Houston [l4thDist.] 2003, pet. denied) Hillard v. Hillard, 725 S.W.2d 722, 723 (Tex. App. – Dallas 1985, no writ.) The beginning point in the characterization and tracing of property is the statutory presumption that property possessed by either spouse during or on dissolution of marriage is community property, TFC Sec. 3.002. This presumption may be overcome by identifying and tracing the property claimed as separate, to a separate source of funds or credit used in its purchase. McKinley, 796 S.W.2d 540. 2

The degree of proof necessary to establish property as separate property is clear and convincing evidence. As a general rule, mere testimony that property was purchased with separate funds, without any tracing, is insufficient to overcome or rebut the community property presumption.

The most common reasons for tracing are:

- To establish the separate character of funds or assets held on account during marriage;

- To establish the separate character of an asset acquired during marriage from separate funds or assets;

- To support a reimbursement claim by demonstrating the use of funds or assets by one marital estate to benefit another marital estate;

- To defeat a reimbursement claim from one marital estate to another by demonstrating that the benefit was paid by the estate receiving the benefit; and

- To prove or disprove an economic contribution or reimbursement claim pursuant to TFC § 3.401 et. seq.

This form of tracing usually involves a large quantity of bank, brokerage, and municipal fund statements and the development of assets and liabilities. A proper tracing requires all the financial records being input into spreadsheets, generally in Microsoft Excel. The monthly bank statement, including deposits and disbursements, must be entered and the running balance must be reconciled. Transfers between accounts must be recognized, and all transactions allocated between the inventory of community funds and separate funds and the allocation of mutations of assets recorded. This same detail tracing is prepared for brokerage accounts. In accordance with the Tex. R. Evid. 1006 exception, summaries of voluminous records will be created in the form of spreadsheets. From the summaries a tracing schedule reflecting the community and separate property balances and the economic contribution or reimbursement claim will be prepared.

The tracing expert must be well read on the family code and court cases, which define the proper method of tracing and tracing rules.

Methods of Tracing.

There are basic principles for tracing and clearly identifying separate property. Typically, tracing schedules will utilize a “community out first” rule and may also employ other theories, as well.

The theories or principles of tracing have been identified as:

- “Community out first” rule;

- Minimum sum balance method;

- Identical sum inference rule and clearinghouse method;

- Item or asset tracing;

- Value tracing;

- Pro rata approach; and

- Before and after accounting (not a valid method).

A large barrier to tracing is dealing with the large volumes of documents, bank statements, checks, deposits, wire transfers, brokerage statements, credit card statements, and other personal and real property that must be analyzed, generally by manually inputting data into MS Excel worksheets. It is estimated that 99% of tracing experts must manually input the data.

Applying the “community out first theory” to the volume of data is intimidating but can be handled by DIO—a proprietary financial investigative program developed by Sage Investigation, LLC over the past 12 years. The program will reduce the amount of time needed to create the worksheets and the human interaction with the data will be for quality control. DIO will thereby lower the cost of tracing without losing any quality of work. It will generate the analysis of the voluminous records into a detailed worksheet that will reflect the require community vs. separate property tracing format. The detail can be summarized into assets and liabilities schedule for use in mediation or in trial.

The DIO software is very beneficial in divorce tracing of funds, income tax cases, and cases involving embezzlement. If you are faced with a complex financial investigation or divorce matter that requires tracing assets and liabilities, contact Sage Investigation, LLC. DIO is waiting to help you process the case data and help your client follow the money and advance the development of your case. To learn more about helping your client contact Retired IRS Special Agent Edmond J. Martin, Chief Investigator at Sage Investigations, LLC, e-mail edmartin@sageinvestigations.com website: www.sageinvestigations.com or call 512-659-3179.

___________________________________

References:

Call

Call